What is Meant by a 10year Certain and Continuous Annuity

Period Certain Annuity

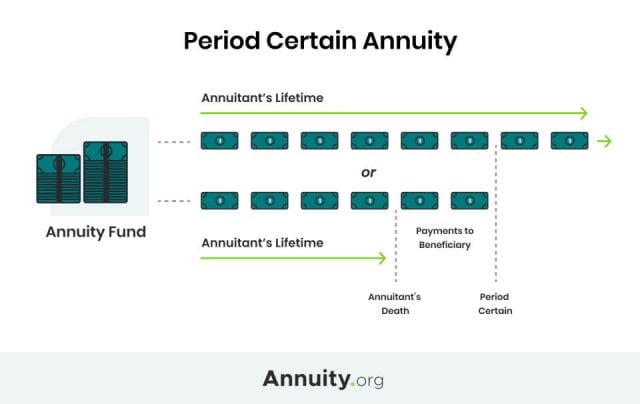

A period certain annuity is a contract that guarantees payments for a specific number of years, as opposed to the annuitant's lifetime. In the event that you die before you recoup your full premium, the payments can be passed to a beneficiary.

![]()

- Written By

Kim Borwick

Kim Borwick

Financial Editor

Kim Borwick is a writer and editor who studies financial literacy and retirement annuities. She has extensive experience with editing educational content and financial topics for Annuity.org.

Read More

- Edited By

Emily Miller

Emily Miller

Managing Editor

Managing editor Emily Miller is an award-winning journalist with more than 10 years of experience as a researcher, writer and editor. Throughout her professional career, Emily has covered education, government, health care, crime and breaking news for media organizations in Florida, Washington, D.C. and Texas. She joined the Annuity.org team in 2016.

Read More

- Financially Reviewed By

Michael J. Boyle, M.S.

Michael J. Boyle, M.S.

Former Compliance Professional

Michael J. Boyle began his career in the securities business in 2011 as a registered financial professional. Over his tenure, he's worked with asset classes including equities, fixed income, CDs, mutual funds, futures, options and foreign currency.

Read More

- Updated: October 12, 2022

- This page features 3 Cited Research Articles

Lifetime annuities are structured to pay out for the duration of an annuitant's lifetime. Insurance companies offset the risk they assume by pooling their clients' premiums and issuing mortality credits to annuity holders who live longer than expected. This is suitable for annuity owners who don't include beneficiaries in their contracts.

But, this structure doesn't work for everyone. If you want the guaranteed income a lifetime annuity provides but also want to leave the balance of your annuity's value to a beneficiary in the event that you pass away unexpectedly, then a period certain annuity may be the right product for you.

What Is a Period Certain Annuity?

Period certain annuities function much like lifetime annuities, but instead of paying out for the rest of the annuitant's life, they pay guaranteed income for a specified period of time — typically 10 to 20 years — regardless of whether the annuitant lives that long. Upon the death of the annuitant, a period certain annuity will continue providing income payments to a beneficiary named in the contract.

A period certain option added to a straight-life or joint and survivor annuity means the insurance company must continue making payments after the death of the annuitant. For this reason, income payments will typically be lower than the periodic payments from a lifetime annuity.

Expand

Life Annuity with Period Certain

A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years.

For example, if you purchase a single-life annuity with a 20-year period certain and pass away 10 years later, your beneficiary will collect income benefits for another 10 years.

Without the period certain option, income benefits will be terminated upon your death, and the insurance company will apply the remaining value of your contract as mortality credits, which they will use to pay the surviving annuitants.

Other annuitization options include:

- Single life/life only

- Joint and survivor

- Lump-sum payment

- Systematic withdrawal

- Early withdrawal

Each of these payout options offers its own unique benefits. Speak with a financial advisor if you are unsure of which option meets your needs.

Benefits of a Period Certain Payout

The inability to accurately estimate their return deters many people from buying annuities. This uncertainty is due to the fact that none of us knows how long we will live.

But with a period certain annuity, you know how long your payments will last. You set your payment schedule. You'll know exactly how many payments you and your beneficiary will receive and the amount of the payments.

In addition, in instances where the period certain is less than the life expectancy of the measuring life, the payments will be larger than payments from a straight-life annuity.

Drawbacks of a Period Certain Payout

Period certain annuitization guarantees income for a specific time period, regardless of whether the annuitant lives that long. This is advantageous if you die prematurely, but if you live beyond the period certain, you won't have the security of regular income payments for the rest of your life.

Michael Kitces of Buckingham Wealth Partners emphasized the value of mortality credits for annuity owners who live past their life expectancy and explained that "trying to protect against an annuity loss in the event of early death, and protect heirs, actually eliminates much of the benefit that annuities are meant to provide in the first place."

This protection is the ultimate goal of a period certain annuity or a life annuity with period certain. Annuity holders who choose this payout option are choosing to forfeit the additional payments they would receive if they lived longer than other annuitants in the insurer's pool.

Please seek the advice of a qualified professional before making financial decisions.

Last Modified: October 12, 2022

3 Cited Research Articles

Annuity.org writers adhere to strict sourcing guidelines and use only credible sources of information, including authoritative financial publications, academic organizations, peer-reviewed journals, highly regarded nonprofit organizations, government reports, court records and interviews with qualified experts. You can read more about our commitment to accuracy, fairness and transparency in our editorial guidelines.

- Hicks, C. (2022, July 7). 16 Things You Need To Know Now About Annuities. Retrieved from https://money.usnews.com/investing/investing-101/articles/things-you-need-to-know-now-about-annuities

- Kitces, M. (2015, April 1). Understanding The Role Of Mortality Credits – Why Immediate Annuities Beat Bond Ladders For Retirement Income. Retrieved from https://www.kitces.com/blog/understanding-the-role-of-mortality-credits-why-immediate-annuities-beat-bond-ladders-for-retirement-income/

- Legal Information Institute. (2022, June). Annuities. Retrieved from https://www.law.cornell.edu/wex/annuity

Source: https://www.annuity.org/annuities/payout/period-certain/

0 Response to "What is Meant by a 10year Certain and Continuous Annuity"

Post a Comment